At the time of writing this post, I’ve been a landlord for several years now and have a pretty good grasp on the pros and cons of rental properties. Unlike the Grant Cardones or mega-success stories you see on YouTube, I’m a middle-class guy who owns rental property and works a day job.

Some benefits of owning rental property will depend on where your property is located. So, while this post will cover a lot of the pros and cons – your list may look different depending on your location.

With that said, I’m going to alternate between pros and cons. A big portion of the benefits of owning rental property also comes with negative aspects, so I’ll keep them grouped together to make reading this list easier.

Table of Contents

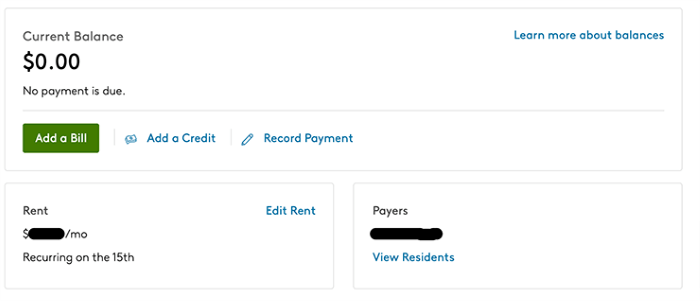

Pro: Rental Income

The most obvious benefit of having a rental property is the rental income. The ability to collect monthly rent is the biggest benefit of rental properties because, without collecting rent, you’d have no way to pay for the property long-term.

My favorite part about collecting rent is that for a majority of the year, it’s passive income. While some months require work to fix things or find new tenants, on a monthly basis – It’s more likely that the rent I receive is passive income and not income I had to do immediate work for.

Recommeded Reading: House Hacking Guide

Here are a few extra advantages of having rental income:

- Gives you more “liquid” money to utilize (the cash flow)

- Should pay down the mortgage for the rental home (helps you build wealth)

- More taxable income allows you to qualify for bigger loans than you could if you only used the income from your job (this could be useful if you found a profitable, but expensive, apartment complex)

Con: Property Expenses

Although it’s exciting to have a steady income stream from collecting rent, it also comes with recurring expenses. If you own a rental property with positive cash flow – this shouldn’t be a big deal.

It’s basically the costs associated with making money on your investment property. Here are some of the property expenses you can expect to have to pay:

- Mortgage payments (principal, interest, property taxes, insurance)

- Maintenance costs (sink faucet leaks, broken handrail, lawn care, etc..)

- Capital expenditures (replace broken appliances, new driveway, new roof, etc..)

- Property management (third-party property manager, finding good tenants, evicting bad tenants, etc..)

Pro: Tax benefits

There are a lot of tax benefits associated with owning a rental property. From being able to write off your expenses (like a normal business) to the actual property being a tax deduction (depreciation) – how you utilize the tax code as a landlord can be a determining factor for your success.

Since I’m not a tax professional, I won’t give you any advice for tax deductions or decisions you can make that would benefit you for tax purposes.

However, I will say that you should 100% consult with a CPA that specializes in taxes and real estate investments. They will be able to tell you how you can take advantage of the tax code and maximize the tax benefits available to you as a rental property owner.

Some questions you may want to ask a CPA:

- What tax deductions are available to me?

- How can I maximize my real estate investments as far as the tax code is concerned?

- How should I structure the ownership of my investment property?

Recommended Reading: Should You Hire A CPA When House Hacking

Con: Finding a consistently good tax professional

I like to think of myself as a relatively smart guy but taxes is one area of my life that seems to get more complicated as I learn more about it. It’s one of the few areas in real estate that I believe should be left to the professionals – especially if you’re new to owning a rental property.

The hard part? Finding a tax accountant that’s consistently good and is willing to accept landlords who don’t have a massive investment portfolio.

In my area, there seem to be a lot of CPAs that only want to deal with high-earning clients. This leaves us, regular landlords, in a position where we use online tax software (like TurboTax) and try consulting with a CPA yearly to make sure there’s nothing obvious that we’re missing.

Using online tax preparation software absolutely gets the job done but, I’m sure there are extra deductions and tax benefits that we’re missing out on.

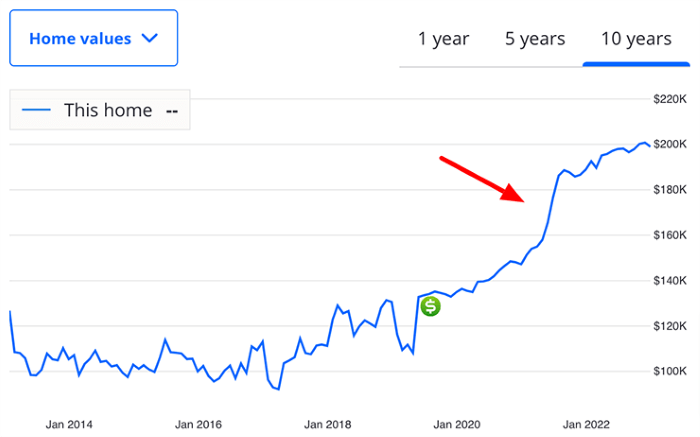

Pro: Property appreciation

The longer you own a rental property, the more likely you are to receive the benefits of rising property values.

As long as your rental property is paying for itself (and ideally has positive cash flow) – any property value increase you receive is an extra benefit you didn’t have to work for.

Property appreciation is the “icing on the cake”. However, here’s the catch: not every property is going to increase in value. Some properties are actually going to decrease in value which, if you need to sell your property, may cause you to sell for a net loss.

I would never recommend you depend on your property rising in value in order for your rental to make financial sense. But, appreciation is definitely a bonus for the people invested in areas that are seeing home value increase.

Con: Property management

In the rental income section above, I stated that income is passive for the majority of the year. This has been true for me and most landlords I know.

However, you need to be available when things go wrong or hire a property manager (which comes with property management fees). And when things do go wrong – you’re the one responsible for figuring out what went wrong, who to hire to fix it (or fix it yourself), and working with the tenant to schedule the fix.

Sometimes the fix is simple (like a leaky faucet) and other times it’s a complete mess (water coming through the foundation).

In addition to maintenance-related problems, you have other things that can go wrong such as:

- difficult tenants causing problems with great tenants in a multi-family rental property

- tenants late on rent

- pest control

Recommded Reading: How To Self-Manage Rental Property

Pro: Tangible investment with more control

This is a big benefit for me. While I also have investments in the stock market, I have no actual control over the outcome of those investments. The executives at the companies I’m invested in are the ones who have control. All I can do while investing in stocks is read financials and make an educated guess on if I’ll be able to make money from my investment.

The main things I can do to influence my stock market success is to buy when prices are low and sell fast when prices are high.

But, owning a rental property gives you a lot more control and flexibility for achieving success. For example, here are a few things I could do to influence my real estate investments:

- Purchase rental property below market value

- Increase rent

- Add additional paid amenities

- Take advantage of low mortgage rates (lower loan payments = more cashflow opportunity)

- Buy property when the housing market is down.

Con: Locked to one location

Owning a rental property locks your investment to one area. This can be good or bad, but overall, it’s a con compared to other investments.

If the area your rental is located in goes downhill, your investment goes downhill right along with it.

Not only are you at the whims of the local rental market in the area of your property but, if you’re a landlord doing your own property management, you have to be available to handle any problems.

Pro: Can use other people’s money

Investing in rental real estate is popular in America. If you’re capable of finding a good deal that makes financial sense on paper – there’s no shortage of people (including banks) who would love to partner with you and invest.

This allows you to put down a low down payment and still get a lot of the benefits. Not everyone wants to partner on real estate deals but, for the people who do, there are several benefits and it allows you to get in the game quicker.

Overall

There are pros and cons to everything – including owning rental property. If you’re the type of person that enjoys investing in things that you can control – I’d highly recommend owning rental property.

Like most things, it has hard and easy moments. But if you’re able to get through the hard moments, you probably have the ability to do really well with rental property.

Frequently Asked Questions

Are rental properties really worth it?

Rental properties are worth it if you’re interested in investments that, with a little work, have both short-term benefits (cash flow) and long-term benefits (owning an asset that can be sold or borrowed against).

Is owning rental property profitable?

Owning rental property can be profitable if you know how to find properties, analyze their profitability, and manage it properly.